AI supply chain optimisation for platelets to reduce costs

54%LESS EXPIRES

100%LESS AD HOC TRANSPORT

06MONTH FULL DIGITAL TRANSFORMATION

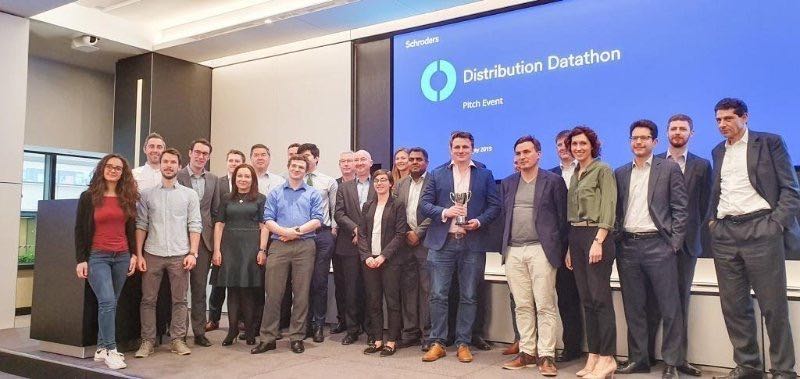

In a related competition in Assets Under Management, we beat Google and their AI service partner to win the Schroders Datathon with GFT and Microsoft.

Kortical's technology proved itself against the major tech players and their AI offerings as well as award winning data-science teams.

Assets Under Management companies make their money by having large funds to manage so keeping the flow of cash in the business is key. Predicting when it will leave is a much harder challenge when the market is constantly moving and clients are moving money around to try to come out on top. Keeping the number of Assets Under Management is key and predicting in advance when they might leave is crucial to keeping ahead in this challenging market. There are many factors to consider and as they are changing rapidly it is not always easy to spot the signals. However using Kortical, the most advanced AutoML platform, we created an AI model to predict which clients would move assets out and we were able to explain why, months in advance.

We had four weeks to prove that we could predict customer churn, we didn't just give them the Kortical platform but did the data-science consulting to deliver the solution as well. In this time-frame we were able to join and preprocess the data for time series modelling, build over 10,000 machine learning models, prove and test the business case and get great results. This is an enormous amount of work for such a short time-frame but by leveraging a huge amount of automation in the AI / ML development process using the Kortical AutoML platform, we’re able to compress months of work to weeks.

This was a complex time-series problem where we joined together multiple datasets - market data, customer data, sales data, cash in and outflow data to give the machine learning (ML) models a reasonably complete picture of the factors that were underlying asset under management churn. Kortical provides time series functionality that can automatically translate time stamped data into time series data ready to by train ML models. It’s not a dumbed down platform and gives data scientists full control over how the features are created or the data scientists can use the smart defaults.

Once the dataset is ready we can kick off the AutoML, this process automates the full ML solution everything from data cleaning, to data preprocessing, to model selection and tuning, whether it’s deep neural networks or xgboost.

As the process goes on and we use the model explainability to see what the main drivers are, we iterate on the AutoML using the high level language to constrain and direct the AutoML, making for tighter iteration and better results. Keeping track of more than 10,000 models is made easy, as all these experiments are automatically tracked logged, tested and scored as well as all the code you need to define them, which also really boosts model development speed.

Once we’d created the models they can be put live in a deployment environment ready to meet strict enterprise SLAs in just a few clicks. These can then be accessed from and Excel spreadsheet, Power BI or a custom app. The platform provides prepopulated code with all the right parameters so using the models is a simple copy and paste.

By supporting simple usage via spreadsheets and Power BI, it’s easy to get started providing the customer lists that can be distributed to the sales team, to prove out the value straight away and once the value is proved, we can integrate the models into the CRM, like salesforce, making it part of business as usual.

We found that we could predict 57% of the customer churn by reaching out to less than 2% of the customer base. This accounted for a large portion of the funds leaving the business.

This was not a low hanging fruit, when we did the Schroders Datathon, none of the rest of the competition were able to build a time series model with any predictive power for this space.

The key here though is that we didn’t just produce a nice report but actionable customer lists that can be used to make an immediate impact without requiring a big IT project. With this approach we can make a meaningful business impact helping sales teams curb asset outflows with AI in weeks.

Whether you're just starting your AI journey or looking for support in improving your existing delivery capability, please reach out.

By submitting this form, I can confirm I have read and accepted Kortical's privacy policy.