AI supply chain optimisation for platelets to reduce costs

54%LESS EXPIRES

100%LESS AD HOC TRANSPORT

06MONTH FULL DIGITAL TRANSFORMATION

The Kortical models were built off the customer account information that had been anonymised and prepared for the FCA.

They gave the full transaction history for a small portion of the bank’s 20 million customers to train the models on with indicators of when default events occurred.

Getting data from large banks is notoriously challenging, we had to beat the top score on a public data-science competition for credit scoring, with 924 teams that entered, to prove we had a market leading solution and that it was worth investing in getting us the data.

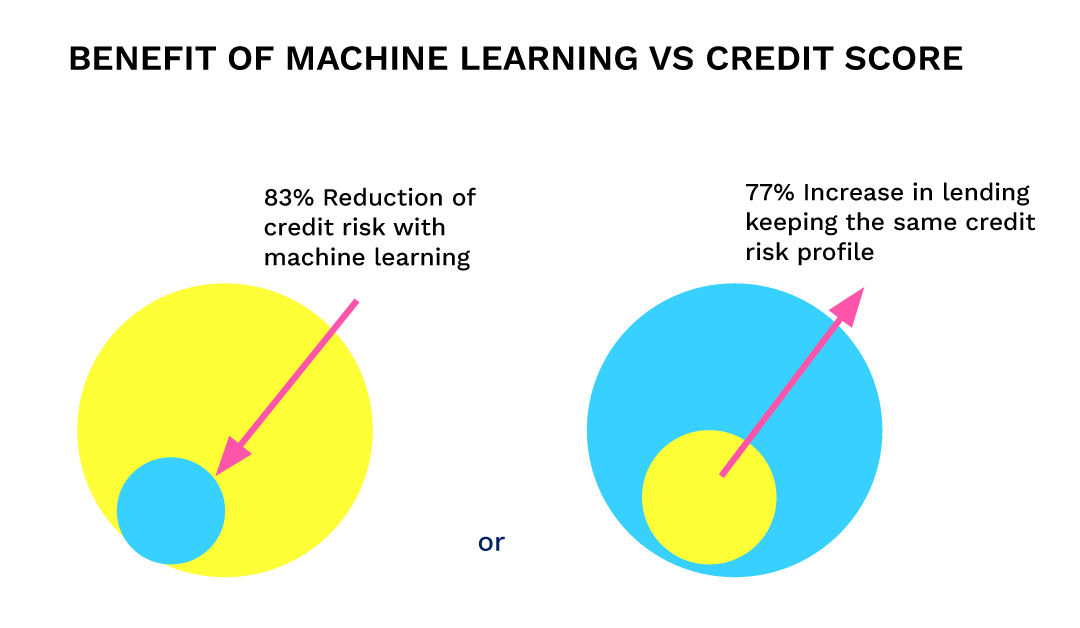

The results were much better than anyone anticipated, catching 83% of bad debt not caught by credit score. Which drastically reduces the bank’s exposure to credit risk. Should they want to keep the same rate of default, they could lend to 77% more people.

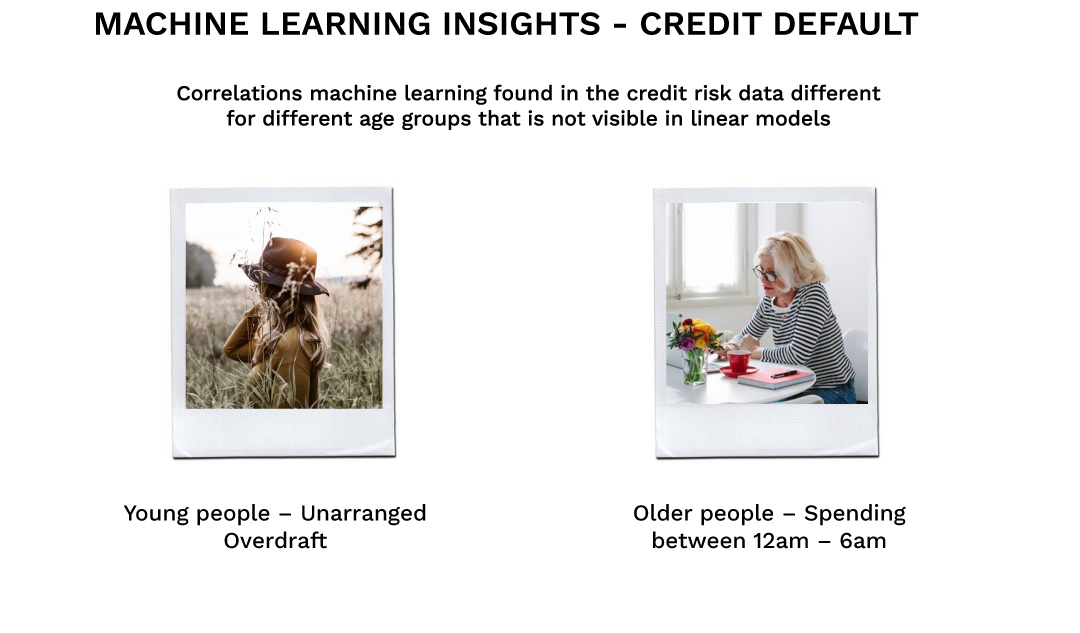

Using the explainability functionality uncovered really interesting insights, notably the customer segments behaved radically different and had contrasting drivers, something that a linear model would not be able to pick up on:

Being able to find different customer segments automatically and their drivers from the data is the reason why machine learning is so much more effective than linear models and rules-based decision engines.

There is a Swedish bank that is applying AI to credit decisions with great success. This technology is enabling them to answer credit applications much quicker than a human reviewing it. They have proved it is more accurate also, which means they are able to capture more of the lucrative lending market and be a stronger business.

If any of these points interest you, do get in touch with us via the form below, we have so much we can share around AI and finance.

Whether you're just starting your AI journey or looking for support in improving your existing delivery capability, please reach out.

By submitting this form, I can confirm I have read and accepted Kortical's privacy policy.